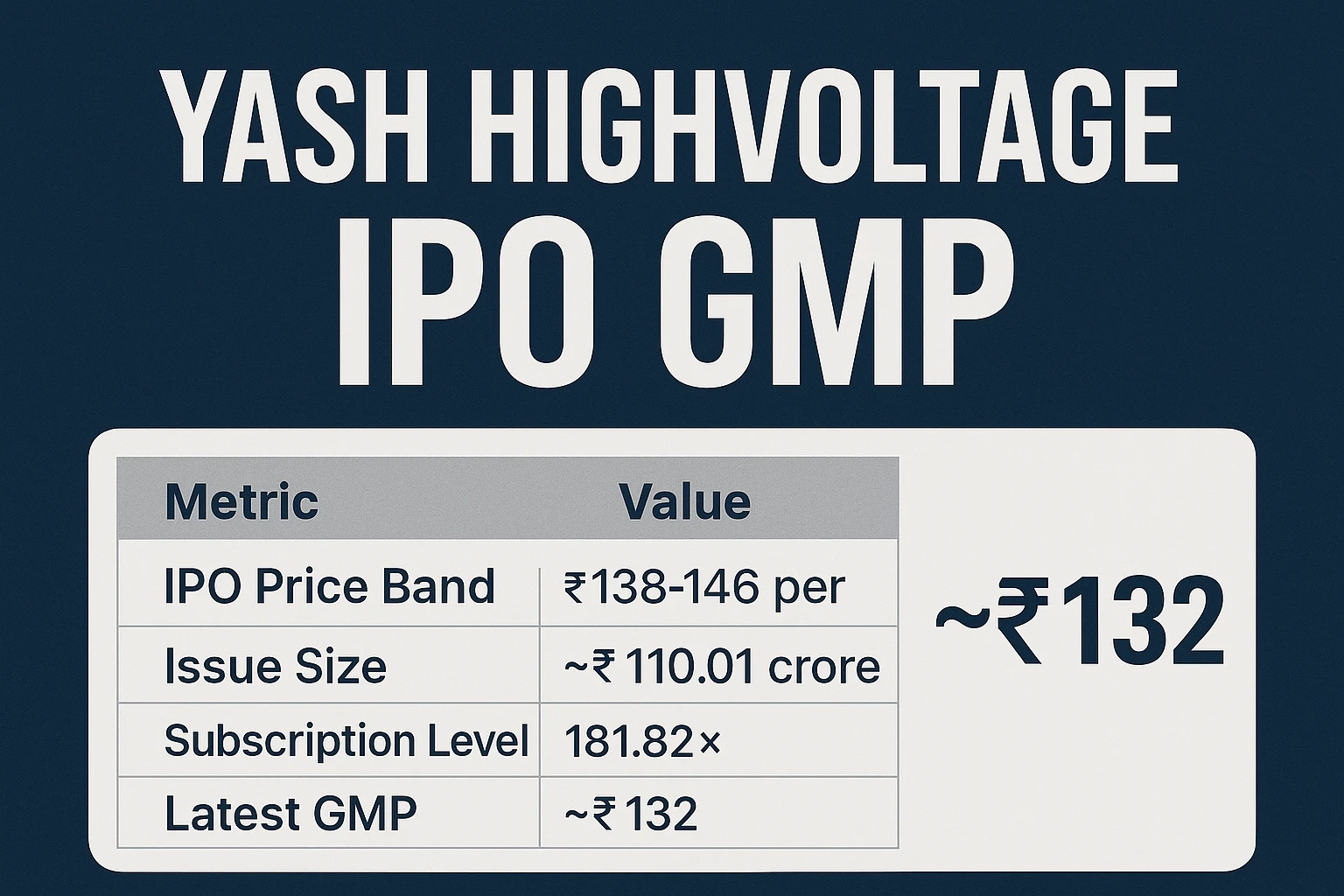

“Yash Highvoltage IPO GMP: ₹132 Premium, 90% Listing Gain Linked to Power Grid Boom”

The Yash Highvoltage Limited IPO GMP (Grey Market Premium) settled around ₹ 132 per share ahead of its listing. IPO Watch+2Investor Gain+2

Stats At a Glance

| Metric | Value | Notes |

|---|---|---|

| IPO Price Band | ₹ 138-146 per share | Groww+1 |

| Issue Size | ~₹ 110.01 crore | ipoplatform.com+2investorzone.in+2 |

| Subscription Level | 181.82× | mint+1 |

| Latest GMP | ~₹ 132 | IPO Watch+1 |

| Listing Date | ~19 December 2024 | mint+1 |

Last Updated: 1 November 2025

What is the Yash Highvoltage IPO GMP?

Let’s break it down in plain English. The term Yash Highvoltage Limited IPO GMP stands for the grey-market premium of the company’s IPO—basically how much above the issue price investors in the grey market are willing to pay, anticipating listing gains.

Here’s what you need to know:

-

GMP positive → indicates strong demand / expected listing gain.

-

GMP negative or low → suggests weak demand or expectation of listing below issue price.

-

GMP is not official — it’s an informal indicator only, not regulated. Always treat it cautiously.

In the case of Yash Highvoltage, the GMP hovering around ₹ 132 meant many expected a pretty good listing. Meanwhile, the issue price band was ₹ 138-146. So the GMP suggests roughly a listing price > issue price by that margin.

Company & IPO Snapshot

To understand the GMP in context, here’s a quick story of the company and its IPO.

About Yash Highvoltage

Yash Highvoltage Limited was incorporated in June 2002. ipoplatform.com+1 The company manufactures and distributes a wide range of transformer bushings (oil-impregnated paper (OIP), resin-impregnated paper (RIP), resin-impregnated synthetic (RIS), etc.). investorzone.in+1 It also provides services like repair, retrofitting of old bushings. Groww

IPO Details

-

Price band: ₹ 138-146 per share. Groww+2ipoplatform.com+2

-

Lot size: 1,000 shares (minimum investment ~₹ 146,000) for retail. Zerodha+1

-

Issue size: ~₹ 110.01 crore. investorzone.in

-

Subscription: ~181.82 times overall. mint+1

-

Listing on BSE SME platform (tentative) around 19 December 2024. mint+1

Financial Snapshot

Some key numbers:

-

FY 22 revenue ~₹ 65.06 cr, PAT ~₹ 8.71 cr. Groww+1

-

FY 23 revenue ~₹ 90.36 cr, PAT ~₹ 11.42 cr. Groww+1

-

FY 24 revenue ~₹ 108.48 cr, PAT ~₹ 12.06 cr. investorzone.in+1

Why the Yash Highvoltage IPO GMP rose the way it did

Here are key reasons — in conversational terms — why GMP shot up and what it signals.

-

High subscription indicating demand. The 181.82× subscription showed strong interest; more demand typically pushes the GMP up.

-

Niche business + growth story. Transformer bushings is a specialized segment; given India’s infrastructure & power-sector push, this added positive sentiment.

-

Limited supply & SME listing. The issue being on SME platform meant fewer shares in public domain; good demand + limited supply often lifts grey market pricing.

-

Positive listing expectations. The GMP around ₹ 132 suggested many believed the listing price could be much higher than the issue band.

-

Short waiting time between issue close and listing. The close to listing gap was short, keeping investor sentiment fresh and active.

Read More: Read More: Crypto30x.com Bitcoin Price: A Comprehensive Analysis of 2025 Trends

What the GMP of ~₹ 132 means practically

-

If you applied at ₹ 138 (lower band) and the listing occurs at ~₹ 138 + ₹ 132 = ~₹ 270 (theoretically) then you’d have made ~100% gain. Of course actual listing price may differ.

-

It gives you a rough-guide of market expectations, but not a guarantee. Grey market is informal.

-

If you’re considering investing, the GMP should be one of many data-points (not only one).

Risks & Things to Watch with this IPO

Yes the GMP looks tasty, but let’s keep it real — there are risks too.

-

GMP is not regulated; official listing price could be lower (or higher).

-

Company depends heavily on transformer bushing segment; any downturn here can hurt. Groww

-

As an SME company, liquidity post-listing might be limited.

-

High GMP may inflate expectations — if listing day doesn’t deliver, sentiment can reverse.

-

Always check fundamentals (financials, business model) not just GMP.

Expert Insights (My Take)

Here are a few insights you won’t always see:

-

With a GMP around ₹ 132, the market was pricing a large listing pop for Yash Highvoltage IPO GMP; for a issue price around ₹ 138-146, that implies listing potential of ~₹ 270 (which is substantial for an SME).

-

But investor enthusiasm may overshoot — high GMP often means expectations are baked-in, leaving less upside after listing.

-

The company’s fundamentals are decent but not perfect (PAT margins ~11%, modest size). So, the risk-reward depends on whether the listing delivers and whether post-listing the company can sustain growth.

-

If you are a retail investor: consider whether you are buying with a short-term listing pop in mind or long-term holding. For the former, GMP indicates upside; for the latter, fundamentals matter more.

Summary in Plain Speak

If you ask: “Should I care about the Yash Highvoltage IPO GMP?” — yes, but don’t get carried away. The GMP of ~₹ 132 tells us that investors in the grey market were expecting a strong listing jump for the Yash Highvoltage IPO GMP. The underlying company has good growth traction, is operating in a niche, and the issue was heavily subscribed. But, GMP is an indicator, not a guarantee. Always check the business, financials and your risk appetite.

Conclusion

The Yash Highvoltage IPO GMP at ~₹ 132 shows strong positive sentiment ahead of listing — indicating expected listing gains. The company is interesting and the issue was well-subscribed. That said, investment decisions should not rest on GMP alone. Understand the company, risks, your investment horizon, and whether you’re chasing a quick listing gain or planning a longer term hold.

Last updated: 1 November 2025

Thank you for reading!

(And thank you to my previous blog post for laying the groundwork – link here!)

FAQs

Q1. What does “Yash Highvoltage IPO GMP today” mean?

It means the current grey market premium of the Yash Highvoltage IPO — how much above the issue price shares are trading unofficially ahead of listing.

Q2. How much was the issue price for the Yash Highvoltage Ltd IPO?

The band was ₹ 138 to ₹ 146 per share. Zerodha+1

Q3. When was the Yash Highvoltage IPO allotment and listing expected?

Allotment was expected around 17 Dec 2024; listing around 19 Dec 2024. mint+1

Q4. Can I rely only on GMP to decide whether to invest?

No. GMP is one signal of demand but not a guarantee of performance. You should review fundamentals, management, business model, and your own risk profile.

Q5. What happens if the listing price is lower than what the GMP suggested?

Then the gain may be smaller or there may even be a listing loss. Grey market expectation may not materialize — that’s the risk.

Q6. How often does GMP change for an IPO like Yash Highvoltage?

Quite frequently in the days leading up to listing — based on demand, market mood, and news. For Yash Highvoltage the GMP ranged from ~₹ 50 initially to ~₹ 132 around listing. IPO Watch+1

Thank you for reading!, For More Blogs:

The Scapia Federal Credit Card: More Than Just a Card

Is Bank of America a Good Bank? 7 Key Factors to Consider Before You Open an Account